Answers

Answer:

Đánh giá sự cần thiết của dự án , Thẩm định kỹ thuật, Thẩm định khả năng vốn tài chính dự án

Explanation:

Related Questions

Aschli, a member, prepares individual tax returns for about 300 clients during the year. In addition, she prepares approximately 50 business returns. Aschli uses three full-time and two per-

diem tax preparers during the busy season to assist her in the preparation of the aforementioned tax returns. Sean Williams has been going to Aschli for the past five years to have joint tax

returns prepared for himself and his wife Madison. Their tax returns for the year 20X6 were completed and filed on April 12, 20X7. Sean and Madison have decided to get a divorce and on

June 16, 20X7 Aschli receives a request from Sean for copies of previously filed tax returns and supporting schedules. On July 12, 20X7 Aschli receives a request from Madison for copies of

the same returns and supporting schedules. Aschli has never met nor spoken to Madison Williams at any time during Aschli's engagement to prepare the joint tax returns for Sean and

Madison Williams. In addition, Sean Williams has requested that information not be provided to Madison Williams. Which of the following statements is true regarding Aschli's obligation to

provide copies to both Sean and Madison Williams as it relates to the rules regarding client confidential information?

C) Since Aschli has never met nor spoken to Madison Williams, Aschli is not obligated to provide copies of returns to her and such disclosure would violate confidentiality rules.

C) Madison Williams must provide Aschli with a legally enforceable subpoena before Aschli can provide Madison with copies of tax returns.

C) Since Aschli has worked exclusively with Sean Williams over the years, Aschli has no obligation to provide copies of returns to Madison Williams and such disclosure would violate confidentiality

rules.

C) None of the above

Answers

Since Aschli has worked exclusively with Sean Williams over the years, Aschli has no obligation to provide copies of returns to Madison Williams and such disclosure would violate confidentiality rules. The correct option is C.

Why is it called a tax return?The word "return" has several definitions, including official reports. An income tax return is, in this sense, a legally required report of pertinent financial information.

About 300 clients receive individual tax return preparation services from member Aschli each year. Additionally, she completes about 50 business tax returns. During the busy season, Aschli employs two per-diem and three full-time tax preparers to help her with the aforementioned tax returns.

Thus, the ideal selection is option C.

Learn more about tax returns here:

https://brainly.com/question/21214035

#SPJ1

Two types of multitasking are:

O Competitive tasking and complex tasking

O Task switching and dual tasking

O Task switching and competitive tasking

Answers

The table below details the composition of an economy’s GDP by spending category.

Category Expenditures (billions of dollars)

Fixed business investment $3,650.00

Durable goods $2,150.00

Exports $650.00

Federal government purchases $1,400.00

New home construction $1,150.00

Imports $780.00

Change in inventories $-250.00

Nondurable goods $4,850.00

Services $8,900.00

State and local government purchases $2,550.00

Use the information in the table to calculate the following:

a) Consumption: $

15900

billion

b) Investment: $

billion

c) Government: $

billion

d) Net exports: $

billion

e) GDP: $

billion

Answers

its e) GDP: $

billion. hope this helps

Use the information in the table to calculate the following as a) Consumption: $ 15900 billion.

a) Consumption: Consumption can be calculated by adding up the spending on durable goods, nondurable goods and services.

Consumption = Durable goods + Nondurable goods + Services

Consumption = $2,150.00 + $4,850.00 + $8,900.00

Consumption = $15,900.00 billion

b) Investment: Investment includes fixed business investment, new home construction and the change in inventories.

Investment = Fixed business investment + New home construction + Change in inventories

Investment = $3,650.00 + $1,150.00 - $250.00

Investment = $4,550.00 billion

c) Government: Government spending includes federal government purchases and state and local government purchases.

Government = Federal government purchases + State and local government purchases

Government = $1,400.00 + $2,550.00

Government = $3,950.00 billion

d) Net exports: Net exports can be calculated by subtracting imports from exports.

Net Exports = Exports - Imports

Net Exports = $650.00 - $780.00

Net Exports = -$130.00 billion (negative value indicates a trade deficit)

e) GDP: GDP is the sum of all spending categories.

GDP = Consumption + Investment + Government + Net Exports

GDP = $15,900.00 + $4,550.00 + $3,950.00 - $130.00

GDP = $24,270.00 billion

To know more about Consumption here,

https://brainly.com/question/31868349

#SPJ2

The operating budget provides a roadmap for financial plans for a short-term, future period. What is a typical “future period” for an operating budget?

Answers

An operating budget is a financial statement that outlines the organization's expenditures and revenues for a specific period.

The operating budget is typically for a fiscal year, which is usually twelve months. The future period for an operating budget is usually a fiscal year or less than a year. The operating budget is critical because it establishes guidelines for financial activities and operations in an organization. It provides a roadmap for financial plans for a short-term, future period, which typically begins on January 1st and ends on December 31st.

An organization creates an operating budget to aid in the allocation of resources and expenditures to achieve its objectives for a given period. A typical operating budget is for a fiscal year. A fiscal year is the period when an organization prepares its financial statements. It is usually 12 months, but it may be shorter or longer depending on the organization. An operating budget typically covers one fiscal year; however, it may be longer or shorter based on the organization's preferences.

The future period for an operating budget is frequently updated to reflect the company's current situation and financial standing. It takes into account the actual results of the previous period and the estimated expenditures and revenues for the upcoming year to develop the operating budget for a future period.

Know more about Operating budget here:

https://brainly.com/question/30766715

#SPJ8

How important are structure and culture compared to the other primary internal considerations for a strategic plan?

Answers

Structure and culture are among the primary internal considerations for a strategic plan. The importance of structure and culture cannot be undermined, as they both play an important role in the success of a company's strategic plan. Although there are other factors that may contribute to the success of a strategic plan, structure and culture are vital. They can be used to leverage the strengths of an organization to achieve its goals.

Structure refers to how an organization is organized and the interrelationships between different departments. A company's structure determines how information flows within the organization, and how employees interact with one another.

An effective structure enables employees to work together efficiently, leading to a higher level of productivity.

Culture refers to the set of values, beliefs, and attitudes that guide the behavior of an organization's members. A positive culture promotes employee engagement, which is essential for achieving an organization's goals.

A company's culture can influence how it deals with problems, how employees communicate with each other, and how they make decisions, among other things.

In conclusion, structure and culture are essential components of an organization's strategic plan.

By investing in a positive culture and a well-defined structure, companies can increase employee engagement, productivity, and ultimately, achieve their goals.

For more question on leverage

https://brainly.com/question/28500715

#SPJ8

Brand equity is…………………?

Answers

Answer:

Brand equity, in marketing, is the worth of a brand in and of itself — i.e., the social value of a well-known brand name.

. A building owner charges net rent of $20 in the first year, $21 in the second year, and $22 in the third year, but is providing six months of free rent in the first year as a concession. Using a 10 percent discount rate, what is the effective rent over the three years

Answers

Answer: $17.28

Explanation:

6 month free concession in first year drops rent to:

= 20 / 2

= $10

Effective rent = [Present value of Year 1 rent + Present value of Year 2 rent + Present value of Year 3 rent ] / [ 1 - (1 / (1 + rate)^ number of years) / rate]

= [(10 / (1 + 10%) ) + (21 / (1 + 10%)²) + (22 / (1 + 10%)³)] * [1 - (1 / (1 + 10%)³/ 10%)]

= (9.09 + 17.355 + 16.5289) / 2.48685

= $17.28

What are cash flow financing activities

Answers

Answer: Cash flow from financing activities (CFF) is a section of a company's cash flow statement, which shows the net flows of cash that are used to fund the company. Financing activities include transactions involving debt, equity, and dividends.

Explanation:

recommendations to maintain accuracy in an organization

Answers

Answer:

notecards

Explanation:

Keep notescards with small bulletpoints with specific points of strategy to memorize best, but that’s just me

SEE

What characters can be included in a macro name? Check all that apply.

letters

numbers

spaces

underscores

BO

symbols

Answers

Answer:

Letter

Number

Underscores

Explanation:

A Macro names should mainly comprise of alphanumeric characters which is made up of mainly letters and numbers. Underscores as well as the first key being in capital is also important.

Space isn’t necessary as it has no clearly defined function .

Answer:

1) Letters

2) Numbers

3) Underscores

Explanation:

got it right on edge

Provide an argument for how Coke's disastrous marketing campaign for New Coke might actually have been a good thing for the company's core product.

Answers

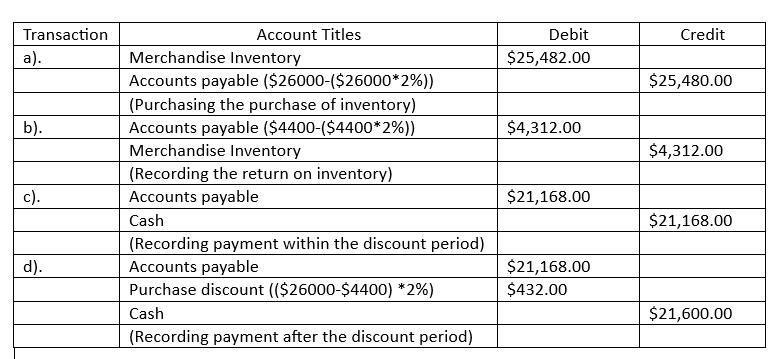

Stylon Co., a women's clothing store, purchased $26,000 of merchandise from a supplier on account, terms FOB destination, 2/10, n/30, using the net method under a perpetual inventory system. Stylon returned merchandise with an invoice amount of $4,200, receiving a credit memo.

Answers

The date, the amount to be credited as well as debited, a short description of the transaction, and the accounts impacted are all included in each journal entry along with other information pertinent to a single business transaction.

What is in a journal entry?Any exchange, whether or not it is an economic one, can be recorded as a diary entry. An accounting journal that displays the debit and credit balances of a business lists transactions. Multiple recordings, each of which is whether its a debit or a credit, may be included in the diary entry.

Business transactions are initially entered into a journal in manual accounting or bookkeeping methods. the name "notebook entry" was born. Depending on the business, it may identify affected divisions, tax details as well as other information.

Journal entries are attached below:

c). Accounts payable = $25,480 - $4,312

= $21,168

To know more about journal entry, visit:

https://brainly.com/question/20421012

#SPJ1

Rest of the question is,

a. Journalize Stylon’s entry to record the purchase. If an amount box does not require an entry, leave it blank.

b. Journalize Stylon’s entry to record the merchandise return. If an amount box does not require an entry, leave it blank.

c. Journalize Stylon’s entry to record the payment within the discount period of 10 days. If an amount box does not require an entry, leave it blank.

d. Journalize Stylon’s entry to record the payment beyond the discount period of 10 days. If an amount box does not require an entry, leave it blank.

If I am under 18 years of age, I am prohibited from using my cell phone while driving unless

Answers

Answer:

Cell phone usage while driving is prohibited at any age

Answer:

unless of emergancy

Explanation:

A person is considered an entrepreneur because she?

Answers

A person is considered an entrepreneur because she combined resources to create new products. Thus, option (c) is correct.

A person who starts a new firm, taking on the majority of the risks and reaping the majority of the gains, is an entrepreneur. Entrepreneurship is the practice of starting a business.

Every economy requires entrepreneurs because they have the knowledge and drive to foresee demands and promote novel ideas. Entrepreneurship that succeeds in assuming the risks involved in founding a firm is rewarded with earnings and expansion possibilities.

Therefore, option (c) is correct.

Learn more about on entrepreneur, here:

https://brainly.com/question/31010585

#SPJ6

A taxpayer who claims a bad debt in the year the debt becomes worthless has how lomg to file an amended return

Answers

Answer: You must deduct a bad debt in the year it becomes worthless. If you realize you could have reported and taken a deduction for an unpaid debt years ago but didn't, you generally have only three years to amend your return in order to claim it on your tax return.

HOPE THIS HELPS

I have $10,967.74 in a brokerage account, and plan to deposit an additional $6,000.00 at the end of every future year until my account totals $270,000 and I expect to earn 13% annually on the account. How many years will it take

Answers

Note that with respect to the deposite, it will take approximately 8.19 years for the account to reach $270,000.

How is this so?To determine how many years it will take for the account to reach $270,000,we can use the future value of an annuity formula.

The formula is -

FV = P x [(1 + r)ⁿ⁻¹] / r

Where -

FV = Future value ($270,000)

P = Annual deposit ($6,000)

r = Interest rate per period (13% or 0.13)

n = Number of periods (number of years)

We need to solve for n, so we can rearrange the formula as -

n = log((FV x r / P) + 1) / log(1 + r)

Plugging in the values -

n = log((270000 x 0.13 / 6000) + 1) / log(1 + 0.13)

Using a calculator, we find that n is approximately 8.19.

thus, it is corect to state that, it will take approximately 8.19 years for the account to reach $270,000.

Learn more about deposit at:

https://brainly.com/question/1438257

#SPJ1

Rajiv has a liability on his car. How is this BEST demonstrated?

You Answered

He has insurance in case of an accident.

He owns his car with no debts.

Correct Answer

He owes $15,000 on his car.

He is trying to sell his car.

CORRECT ANSWER: he owest $15,000 on his car.

Answers

Rajiv's liability on his car is best demonstrated by stating that he owes $15,000 on his car and that he is trying to sell it to pay off his debt.

When we talk about liabilities, we are referring to the amount of money that a person owes to another person or an institution. In the case of Rajiv, the fact that he has a liability on his car means that he owes money to someone or an institution for his car. In this context, it is best demonstrated by stating that Rajiv owes $15,000 on his car. This means that he has taken a loan from someone or an institution to purchase the car and he is yet to pay back the amount he borrowed. Another indication that Rajiv has a liability on his car is the fact that he is trying to sell it.

Selling the car would allow Rajiv to raise the money he needs to pay back his loan and become debt-free. This means that the sale of the car would go towards paying off the liability he owes on his car. While having insurance in case of an accident is a wise decision for any car owner, it does not necessarily demonstrate that Rajiv has a liability on his car. Insurance is a safety net that protects a car owner in case of an accident or damage to the car. However, it does not necessarily indicate that the car owner has a liability on their car.

For more such questions on liability

https://brainly.com/question/25687338

#SPJ11

Question 8 of 10

What is one effective strategy for managing credit card debt?

A. Replacing low-interest credit cards with high-interest options

B. Spending your full credit limit before making a payment

O

C. Ensuring that all of your credit card bills are paid on time

D. Paying only the minimum monthly payment on all credit cards

SUBMIT

Answers

Answer: C. Ensuring that all of your credit card bills are paid on time

Explanation:

Paying your credit card balance in time will mean that you won't get charged interest or any other fees. This assumes there's no annual fee or any other kind of fee. It's possible with some cards that you can use them without any interest attached at all. Simply pay off the balance.

The credit card company banks on the fact that many people either can't or forget to pay off the month's balance, which incurs penalties and other fees. The credit card company also hopes that people pay the minimum monthly payment, which is the slowest way to pay off the debt and incurs the highest amount of fees. This option is definitely not recommended. So we can rule out choice D.

We can also rule out choices A and B. The goal is to have the lowest interest rate as possible. The lower the rate, the lower the interest if any applies. Choice B is a bad idea because you should have some cushion in your credit card balance.

What accounting book is used to capture changes to the trial balance

Answers

The accounting book used to capture changes to the trial balance is the general Journal.

The general journal is a chronological record of all financial transactions that affect account balances, including adjustments and corrections. It is where entries are first recorded before being posted to the appropriate accounts in the general ledger.

Journal entry refers to the process of entering business transactions in a journal called a Journal, which is then used to prepare the company's financial statements. The journal data will be extracted in order to create a ledger report.

The general journal assists in maintaining an accurate and full record of all modifications made to the trial balance, assuring the accounting system's integrity.

Learn more about trial balance, here:

https://brainly.com/question/28541140

#SPJ1

The lender will charge a one-and-a-half-point origination fee and two loan discount points.

What will be the total due for points on a $115,000 loan?

A) $1,725

B) $2,300

C) $4,025

D) $575

Answers

(c) $4025 is the correct option.

Banks charge origination points in exchange for reviewing, processing, and approving your home loan application. Origination points are not standardized and can be a flat fee, a percentage of your total loan amount, or none at all. Discount and origination points are two distinct charges Loan origination takes time. Banks must create all of the paperwork associated with a home loan, in addition to pulling your credit score, reviewing your bank statements, verifying your income and savings, and determining your creditworthiness. In exchange for all of this work, they'll charge you a fee. These fees are known as "origin points.".

learn more about point Origination here:

https://brainly.com/question/27527117

#SPJ9

A sector of jobs that provide people with a service like a haircut.

Industry Service

Industry

Performance industry

Answers

Answer:

service industry

Explanation:

works for customer but isn't involved in manufacturing

The sector of jobs that provide people with a service like a haircut belongs to the "Service Industry" or the "Service Sector."

What is the Industry ServiceThe service industry includes a wide range of businesses and jobs that provide intangible products or services to customers. It involves activities where people offer their knowledge, skills, or labor to satisfy the needs of other individuals or businesses.

Examples of jobs in the service industry include hairdressers, barbers, restaurants, hotels, healthcare providers, consultants, entertainment services, and many others.

Read more on Industry Service here https://brainly.com/question/30001696

#SPJ3

WHAT IS A CALCULATED INTEREST RATE

Answers

Answer:

Use this simple interest calculator to find A, the Final Investment Value, using the simple interest formula: A = P(1 + rt) where P is the Principal amount of money to be invested at an Interest Rate R% per period for t Number of Time Periods. Where r is in decimal form; r=R/100; r and t are in the same units of time.

Explanation:

What would happen to the U.S. economy if all or most manufactures here made 80-85% of their own parts like SpaceX and Tesla?

Answers

Answer:

The U.S economy won't fall, but it will have some problems.

Explanation:

Now,

If all manufactures start making their own parts, the U.S Government wont have any customers to buy the resources needed to make a part. These Manufacturers will have to make mines and factories of their own to do this. It is unlikely that manufacturers will make factories or mines to make their own parts because it is going to be a huge project and its going to cost a lot of money which will be a lose-lose situation because both the U.S and the manufacturers are not going to benefit.

order the steps for inserting a video into a presentation, using a media slide template

Answers

Answer:

The answer is below

Explanation:

To embed a video file for a presentation in a Microsoft Powerpoint, here are the following steps to take in order:

1. Click on the specific file you want to add the video, follow up by clicking on the Menu, then Insert.

2. From the Insert tab, click the Video drop-down arrow, follow up by clicking the Video on My PC.

3. Find and select your specific video file, then click Insert.

4. Modify the settings in the Video Format toolbar to ensure the video plays accordingly

5. Make a preview of your presentation to confirm that your video plays accordingly.

Answer:

1. Insert a new slide based on the template

2. click the video icon

3. locate and select a video file

4. click the insert button

5. adjust the appearance of the video

Explanation:

edge answer. hope this helps :)

WBS for the knowledge area of Human/Resource Management for a low-cost housing project

Answers

Here's an example of a WBS for the knowledge area of Human/Resource Management for a low-cost housing project:

The wbs for a knowledge area of Human/Resource Management for a low-cost housing projectHuman/Resource Management

1.1 Staffing Plan

1.1.1 Define project roles and responsibilities

1.1.2 Identify required staffing resources

1.1.3 Determine the project team structure

1.1.4 Develop a staffing plan and budget

1.2 Recruitment and Selection

1.2.1 Create job descriptions and specifications

1.2.2 Advertise and promote job openings

1.2.3 Review resumes and conduct initial screenings

1.2.4 Conduct interviews and select candidates

1.2.5 Perform background checks and reference checks

1.2.6 Extend job offers and negotiate terms

1.3 Training and Development

1.3.1 Assess training needs for project team members

1.3.2 Develop a training plan and schedule

1.3.3 Conduct training sessions and workshops

1.3.4 Provide on-the-job training and mentoring

1.3.5 Evaluate training effectiveness and adjust as needed

1.4 Performance Management

1.4.1 Set performance expectations and goals

1.4.2 Monitor and assess individual and team performance

1.4.3 Provide feedback and coaching to improve performance

1.4.4 Conduct performance appraisals and evaluations

1.4.5 Identify and address performance issues or conflicts

1.5 Resource Allocation

1.5.1 Identify project resource requirements

1.5.2 Allocate resources based on project needs

1.5.3 Monitor resource utilization and availability

1.5.4 Optimize resource allocation to meet project objectives

1.6 Stakeholder Management

1.6.1 Identify project stakeholders and their interests

1.6.2 Develop a stakeholder engagement plan

1.6.3 Communicate and manage stakeholder expectations

1.6.4 Address stakeholder concerns and resolve conflicts

1.6.5 Maintain positive relationships with stakeholders

Read more on Human resource management here: https://brainly.com/question/14419086

#SPJ1

The score report of the wore. Test offers all of the following information except

Answers

Answer:

That doesn't make sense can you elaborate please?

The 15-year average return for the S&P 500 from January 1973 to December 2016 (29 separate 15 year periods) was as high as a 20% average annual return and as low as a 3.7% average annual return. Additionally, the average dividend yield for the S&P is 4.11% and the average annual dividend growth rate is 6.11%.

Using this information, please compare the investment in the 5% 15-year corporate bond with a $100,000 investment in a stock with a 3.7% dividend yield (10 percent less than the S&P 500 average yield) and a 3% dividend growth rate (50 percent of the S&P 500 dividend growth rate).

The annual investment returns are as follows:

Year 1 (13.40%) Year 2 (23.37%) Year 3 26.38% Year 4 8.99%

Year 5 3.00% Year 6 13.62% Year 7 3.53% Year 8 (38.49%)

Year 9 23.45% Year 10 12.78% Year 11 0.00 Year 12 13.41%

Year 13 29.60% Year 14 11.39% Year 15 (0.73%)

The bond interest payment of 5 percent is paid annually and not reinvested. To compare accurately with the bond investment, the stock dividend will not be reinvested, but paid annually as well.

Please calculate the value of the stock account at the end of each year and the dividend income from the stock on an annual basis.

Once you have performed the calculations, please let me know if you prefer to invest in a 5% corporate bond for 15 years or the stock and why.

What is the value of the stock after year 2? Year 8? Year 11? When does the annual dividend income of the stock exceed the annual interest income of the bond?

Answers

1. The value of the stock account after Year 2 is $155,401.626.

2. The value of the stock account after Year 8 is $96,110.0674.

3. The value of the stock account after Year 11 is $96,110.0674.

4. The annual dividend income of the stock exceeds the annual interest income of the bond at the end of Year 15.

Bond interest rate: 5%

Stock dividend yield: 3.7% (10% less than S&P 500 average yield)

Stock dividend growth rate: 3% (50% of S&P 500 dividend growth rate)

We'll assume an initial investment of $100,000.

Year 1:

Bond interest income: $100,000 * 0.05 = $5,000

Stock dividend income: $100,000 * 0.037 = $3,700

Value of stock account: $100,000 + ($100,000 * 0.2337) = $123,370

1. Year 2:

Bond interest income: $100,000 * 0.05 = $5,000

Stock dividend income: $100,000 * 0.037 = $3,700

Value of stock account: $123,370 + ($123,370 * 0.2638) = $155,401.626

2. Year 8:

Bond interest income: $100,000 * 0.05 = $5,000

Stock dividend income: $100,000 * 0.037 = $3,700

Value of stock account: $155,401.626 + ($155,401.626 * (-0.3849)) = $96,110.0674

3. Year 11:

Bond interest income: $100,000 * 0.05 = $5,000

Stock dividend income: $100,000 * 0.037 = $3,700

Value of stock account: $96,110.0674 + ($96,110.0674 * 0) = $96,110.0674

4. At the end of Year 15, the dividend income of the stock exceeds the interest income of the bond.

Stock dividend income: $100,000 * 0.037 = $3,700

Bond interest income: $100,000 * 0.05 = $5,000

For such more question on account:

https://brainly.com/question/28326305

#SPJ8

How does the HR department handle sourcing of staff and the hiring process?

One of the key forms that a new employee has to fill in upon joining a a company is form______

A. W-2

B. W-4

C. Workplace compensation form

You can directly source young temporary resources in large numbers with less cost time from ______

A.employee agencies

B.trade fairs

C. Universities

Answers

Answer:

C

Explanation:

new employee before joining a company has to to fill in or sign a contract and workplace compensation form

Answer:

C. Workplace compensation form

A.employee agencies

Explanation:

nslfdnanfqnwfnlqnlwnflqnflnwfnlqk

Answers

hi

have a great day

what is this??

What is the meaning of 50k in 2018?

Answers

Answer:

50,000

Explanation:

i hope it helped ya <3