the idea that employees should receive a raise in pay based upon their contributions to the organization, and not based on their gender, is consistent with which principle?

Answers

The correct answer for this question is Remuneration policies that they apply a physically fair pay procedure for all staff.

The rule of equivalent compensation for male and female laborers for equivalent work or work of equivalent worth is

set down in Article 157 of the Deal on the Working of the European Association (TFEU). The CRD

expects establishments to guarantee that they apply a sexually unbiased compensation strategy for all staff,

counting their daring people, for example a compensation strategy in light of equivalent compensation for male and female

laborers for equivalent work or work of equivalent worth. A similar standard applies to laborers of all different sexes when executed into public regulation.

to know more about compensation click here:

https://brainly.com/question/21335829

#SPJ4

The correct answer for this question is Remuneration policies that they apply a physically fair pay procedure for all staff.

The rule of equivalent compensation for male and female laborers for equivalent work or work of equivalent worth is

set down in Article 157 of the Deal on the Working of the European Association (TFEU). The CRD expects establishments to guarantee that they apply a sexually unbiased compensation strategy for all staff,

counting their daring people, for example a compensation strategy in light of equivalent compensation for male and female laborers for equivalent work or work of equivalent worth. A similar standard applies to laborers of all different sexes when executed into public regulation.

to know more about compensation click here:

brainly.com/question/21335829

#SPJ4

Related Questions

In 2017, Blake purchased a new home. In addition to the purchase price of $200,000, he paid $700 in legal fees and $2,000 in recording costs. In 2019, he added a deck at a cost of $5,000. Blake's basis in his home is:

Answers

Answer:

$207,700

Explanation:

Blake's basis in his home in 2017 = purchase price + legal and administrative fees = $200,000 + ($700 + $2,000) = $202,700

Since the deck that Blake added to his home is considered an improvement that is permanent and increases the home's value, it will also increase the home's basis = $202,700 + $5,000 = $207,700

The Outpost, a sole proprietorship currently sells short leather jackets for $369 each. The firm is considering selling long coats also. The long coats would sell for $719 each and the company expects to sell 820 a year. If the company decides to carry the long coat, management feels that the annual sales of the short jacket will decline from 1,120 to 1,040 units. Variable costs on the jacket are $228 and $435 on the long coat. The fixed costs for this project are $23,100, depreciation is $10,400 a year, and the tax rate is 34 percent. What is the projected operating cash flow for this project

Answers

Answer:

$134,546

Explanation:

Calculation to determine the projected operating cash flow for this project

Projected operating cash flow=

{[820 × ($719 − 435)] + [(1,040 − 1,120) × ($369 − 228)] − $23,100} × {1 − .34} + {$10,400 × .34}

Projected operating cash flow={[820 × $284)] + [$80 × $141] − $23,100} × {.66} + {$3,436}

Projected operating cash flow= $134,546

Therefore the projected operating cash flow for this project is $134,546

What is the range of this

data?

7, 2, 5, 1, 3

Answers

Answer:

1 and 7

Explanation:

The answer is 6. You have to subtract the smallest number from the biggest number.

Some managers commit fraud because they are under great pressure to report a high net income to meet?

Answers

Some managers may commit fraud due to the pressure to report a high net income to meet certain targets or expectations. This pressure can arise from various sources, such as internal performance targets, external investor expectations, or the desire to secure bonuses or promotions.

In order to manipulate financial statements and inflate net income, managers may engage in fraudulent activities like improper revenue recognition, overstating assets, understating liabilities, or manipulating expenses. These actions are unethical and illegal. The motivation behind this behavior is often the fear of negative consequences, such as job loss or damage to reputation, if the company fails to meet financial targets. Some managers may feel that the pressure to perform outweighs the risks associated with fraudulent activities.

However, it is important to note that committing fraud is not an acceptable solution to the pressure faced by managers. There are legal and ethical alternatives, such as improving operational efficiency, exploring cost-saving measures, or communicating openly with stakeholders about challenges faced by the company. Overall, managers should prioritize integrity, transparency, and ethical decision-making to avoid the temptation of committing fraud under pressure to report a high net income.

To know more about performance targets refer to:

https://brainly.com/question/24249441

#SPJ11

vancouver timber and milling, incorporated on january 2, 2024, for $460 million. at the date of purchase, the book value of vancouver's net assets was $805 million. the book values and fair values for all balance sheet items were the same except for inventory and plant facilities. the fair value exceeded book value by $5 million for the inventory and by $30 million for the plant facilities. the estimated useful life of the plant facilities is 15 years. all inventory acquired was sold during 2024. vancouver reported net income of $200 million for the year ended december 31, 2024. vancouver paid a cash dividend of $20 million. required: prepare all appropriate journal entries related to the investment during 2024. what amount should northwest report as its income from its investment in vancouver for the year ended december 31, 2024? what amount should northwest report in its balance sheet as its investment in vancouver? what should northwest report in its statement of cash flows regarding its investment in vancouver

Answers

Northwest reports $205 million as its income from investment in Vancouver, $460 million in the balance sheet, and $20 million cash outflow.

Diary sections for 2024:

Interest in Vancouver Wood and Processing, Inc. - $460 million

Cash - $460 million

Stock - $5 million

Interest in Vancouver Wood and Processing, Inc. - $5 million

Plant Offices - $30 million

Interest in Vancouver Wood and Processing, Inc. - $30 million

Interest in Vancouver Wood and Processing, Inc. - $20 million

Profit Pay - $20 million

Northwest's pay from its interest in Vancouver for the year finished December 31, 2024, ought to be $200 million, which is the net gain detailed by Vancouver.

Northwest ought to report its interest in Vancouver at fair worth, which is $495 million ($460 million + $5 million + $30 million).

With respect to interest in Vancouver, Northwest ought to report a surge of $20 million in its articulation of incomes, which addresses the profit got from Vancouver.

To learn more about vancouver timber, refer:

https://brainly.com/question/14244992

#SPJ4

Explain how herbs are used in treating any

5 diseases

Answers

Answer:

An herb is a plant or plant part used for its scent, flavor, or therapeutic properties. Herbal medicines are one type of dietary supplement. They are sold as tablets, capsules, powders, teas, extracts, and fresh or dried plants. People use herbal medicines to try to maintain or improve their health.

Explanation:

Hope it helps u

FOLLOW MY ACCOUNT PLS PLS

a.) $2894.71

b.) $2202.72

c.) $2330.20

d.) $2654.23

Answers

How important is money

Answers

Answer:

very important

Explanation:

money is a global income source for everyone. we all have different types but it is all still money. now say one country got rid of money and had people pay for stuff using other things. if china did that lots of different countries wouldn't be able to get stuff from there unless they had so much of that product they could just give it up.

Emma is a high school student with a part-time job. She is not eligible for any employer sponsored plan. She wants to start investing for retirement. What is the best type of account for her to use

Answers

The best type of account for her to use is: Individual retirement account.

What is individual retirement account?An individual retirement account is a form of saving account that enables an individual to save ahead of retirement.

Individual retirement account is important for people that want or desire to save retirement.

Since Emma want to start investing for retirement the best choice is for Emma to open an individual retirement account.

Inconclusion the best type of account for her to use is: Individual retirement account.

Learn more about Individual retirement account here:https://brainly.com/question/1637877

What effects did zaha have on guggenheim new york?

Answers

The effects that Zaha had on Guggenheim New York is that her current retrospective at the Solomon R. Guggenheim Museum in New York gives ample evidence of her genius. She has been busy and produced a staggeringly impressive body of work that is without equal for its inventiveness. This saved urban space and merges the elements of its surroundings. It also projects a brand new artificial landscape outweighted by funnel-shaped cones. The Solomon R. Guggenheim Museum, often referred to as The Guggenheim, is an art museum at 1071 Fifth Avenue on the corner of East 89th Street on the Upper East Side of Manhattan in New York City.

Who is Zaha Hadid?Dame Zaha Mohammad Hadid DBE RA was a British-Iraqi architect, artist and designer, recognised as a major figure in architecture of the late 20th and early 21st centuries.

Therefore, the correct answer is as given above

learn more about Zaha Hadid: https://brainly.com/question/7083561

#SPJ1

If during the fiscal year, the federal government takes in $3 trillion in taxes, but

spends $4 trillion, the government will have run what is called

Answers

Answer:

A fiscal deficit

Explanation:

A fiscal deficit is a condition where the government expenditures exceed its income. It is when the total budgeted expenditure estimates are more than the projected government's income. A government that budget deficits year after year is living beyond its means.

The actual fiscal deficit can be calculated by subtracting the expenditure from the projected income. In this case, the government fiscal deficit will be $1 trillion.

Which type of product advertisement can be used to sell a company’s product when two or more other companies are selling the same product?

Answers

Answer:competitive advertising

Explanation:

I’m not for sure but I think that might be the answer

Answer: competitive advertising

Explanation:

if on online course it is what was right

carmen camry operates a consulting firm called help today, which began operations on december 1. on december 31, the company’s records show the following selected accounts and amounts for the month of december.

Answers

Cash: $4,000 - This amount represents the total cash receipts for the month, including any money collected from customers, payments received from vendors, and any other sources of cash.

Accounts Receivable: $6,000 - This amount represents money that Carmen Camry's consulting firm is owed by customers for services rendered in the month of December.

Accounts Payable: $3,000 - This amount represents money that Carmen Camry's consulting firm owes to vendors for expenses incurred in the month of December.

To know more about accounting here

https://brainly.com/question/28932788

#SPJ4

with the aid of industry and individual producer graphs explain how the long run equilibrium in perfect market will be achieved when an economic loss was made in the short run

Answers

In a perfectly competitive market, the long-run equilibrium is achieved through the process of entry and exit of firms. When an economic loss is incurred by individual producers in the short run, it signals an imbalance between the market price and the average total cost of production.

When individual producers experience economic losses, some firms will choose to exit the market in the long run. This exit occurs because firms are unable to cover their costs and generate profits. As a result, the supply in the market decreases, shifting the supply curve to the left. The reduction in supply leads to a decrease in the quantity of goods or services available in the market, which in turn puts upward pressure on prices.

As prices rise, the remaining producers who were able to operate at a lower cost may start to earn economic profits. This attracts new firms to enter the market, anticipating the opportunity to make profits. The entry of new firms increases the supply in the market, shifting the supply curve to the right.

The increased supply eventually leads to a decrease in prices, as competition intensifies among producers. This process continues until a long-run equilibrium is reached, where the market price equals the average total cost of production for each firm.

Graphically, this adjustment is represented by the shifting of the supply curve to the left in the short run due to firm exits, followed by a subsequent shift to the right in the long run due to new firm entries. The new long-run equilibrium occurs at the intersection of the demand and supply curves, where price equals average total cost, ensuring that firms earn zero economic profit.

Overall, the long-run equilibrium in a perfect market is achieved through the exit and entry of firms in response to economic losses or profits, respectively, leading to price adjustments and the restoration of equilibrium.

For more such questions on equilibrium

https://brainly.com/question/28945352

#SPJ8

Pick a business that existed prior to the commercialization of

internet. Evaluate how their marketing strategy has changed after

the internet? What are the key differences?

Answers

A business that existed prior to the commercialization of the internet is the promotion of music videos.

The marketing strategy of promotion of music videos has changed after the commercialisation of the internet. The commercialization of the Internet entails the creation and oversight of online services for monetary gain. It usually entails increasing monetization of network services and consumer products mediated by various Internet technologies. E-commerce, electronic money, as well as advanced marketing techniques such as personalised and targeted advertising are all common forms of Internet commercialization.

It has enabled them to reach a larger audience than they would have been able to reach through traditional marketing methods. Second, eCommerce has simplified the process of finding what customers are looking for. Before making a purchase, they can now compare prices and read reviews.

Learn more about internet, here:

https://brainly.com/question/16721461

#SPJ4

An upper-level is manager proposes that his organization implement a system to consolidate shipping and exception data from multiple carriers so that consumers know when their purchase will ship and when it will arrive. What business strategy does this represent?.

Answers

An upper-level manager proposes that his organization implement a system to consolidate shipping and exception data from multiple carriers so that consumers know when their purchase will ship and when it will arrive. This represents a differentiation business strategy.

What are business strategies?A business strategy lays out the course of action that will be taken to fulfill the organization's vision and goals, as well as how to make decisions that will increase the company's financial stability in a cutthroat market.

In order to differentiate themselves from the products that their rivals may provide in the market, businesses must offer clients something special, distinctive, and different. Increasing competitive advantage is the main goal of putting a differentiation strategy into practice.

To know more about business strategies visit:- https://brainly.com/question/28561700

#SPJ4

The accelerated investment incentive was introduced in Fall

2018. What was the impact of it? Why do you believe it has been

introduced after many years to decades of little major changes in

capital co

Answers

The accelerated investment incentive that was introduced in Fall 2018 allowed businesses to write off a larger portion of their capital investments in the first year, rather than spreading it out over several years. This was done to encourage businesses to invest more in their operations and equipment, thereby stimulating economic growth and job creation.

By providing a financial incentive for businesses to make these investments, the government hoped to boost productivity and competitiveness, which would ultimately benefit the economy as a whole.

One reason why this incentive may have been introduced after many years of little major changes in capital co is that the government may have been looking for new ways to stimulate economic growth and job creation. In recent years, many advanced economies have struggled to achieve sustained growth, and this has led policymakers to look for new policy tools to help jump-start the economy. By providing a financial incentive for businesses to invest in their operations and equipment, the government can help to increase productivity and competitiveness, which can ultimately boost economic growth and job creation.

Another reason why this incentive may have been introduced is that technological advancements have made it possible for businesses to invest more in their operations and equipment without incurring significant costs. For example, automation and other digital technologies have made it possible for businesses to produce more goods and services with fewer workers, which has reduced the need for capital investments in the past. However, as these technologies continue to evolve and become more affordable, businesses may be more willing to invest in them, which could help to boost productivity and competitiveness.

More on investment incentive: https://brainly.com/question/25287796

#SPJ11

A 20-unit apartment building sells for $5 million. The property can bring in $400,000 in annual gross income. What is the gross income multiplier (GIM)

Answers

The gross income multiplier (GIM) is 12.5.

Gross income multiplier (GIM)Using this formula

Gross income multiplier (GIM)=Sales price/Annual gross income

Where:

Sales price=$5million

Annual gross income=$400,000

Let plug in the formula

Gross income multiplier (GIM)=$5 million/$400,000

Gross income multiplier (GIM)=12.5

Inconclusion the gross income multiplier (GIM) is 12.5.

Learn more about gross income multiplier (GIM) here:https://brainly.com/question/25804493

Marianne was a computer programmer making almost $170,000 a year at a rate of $80 an hour for Big Tech. Ginger, her boss, demanded that she work 100 hours of overtime over the next month until a large project was complete. Marianne believes she is entitled to 100 hours of overtime pay. Under the Fair Labor Standards Act, how much overtime pay is she entitled to

Answers

Under the Fair Labor Standards Act, Marianne is entitled to $12,000 for overtime pay.

What is the overtime rate under the Fair Labor Standards Act?Under the Fair Labor Standards Act, the overtime rate is a time and a half.

Data and Calculations:Annual salary = $170,000

Rate per hour = $80

Overtime rate per hour = $120 ($80 x 1.5)

Overtime hours = 100 hours

Overtime pay = $12,000 (100 x $80 x 1.5)

Thus, under the Fair Labor Standards Act, Marianne is entitled to $12,000 for overtime pay.

Learn more about the Fair Labor Standards Act at https://brainly.com/question/499564

#SPJ1

How is a credit union different from a bank?

O Acredit union offers services to companies instead of individuals.

A credit union only offers credit, it does not store money.

Acredit union is usually larger than a bank.

O A credit union is owned by its customers.

Answers

Answer:

a credit union is owned by its costumers (D)

Explanation:

i took the assignment!!

tiaa-cref, teamsters' union, and calpers are all primarily:

Answers

TIAA-CREF (Teachers Insurance and Annuity Association - College Retirement Equities Fund), the Teamsters' Union, and CalPERS (California Public Employees' Retirement System) are all primarily associated with retirement or pension-related activities.

TIAA-CREF is a financial services organization that provides retirement products, investment management, and financial planning services primarily for educators and academic, research, medical, and cultural fields.

The Teamsters' Union, formally known as the International Brotherhood of Teamsters, is a labor union representing various workers, including truck drivers, warehouse workers, and other transportation industry employees. The union often negotiates pension and retirement benefits on behalf of its members.

CalPERS is a public pension fund serving public employees, retirees, and their beneficiaries in California. It manages retirement and pension benefits for state and local government employees in California and invests the contributions to provide retirement income in the future.

Thus, all three organizations are primarily involved in managing or providing retirement-related services, whether through financial products, union negotiations, or pension fund management.

To know more about retirement refer to-

https://brainly.com/question/31284848

#SPJ11

Bracey Company manufactures and sells one product. The following information pertains to the company’s first year of operations:

Variable cost per unit: Direct materials $ 34

Fixed costs per year: Direct labor $ 495,000

Fixed manufacturing overhead $ 453,750

Fixed selling and administrative expenses $ 78,000

The company does not incur any variable manufacturing overhead costs or variable selling and administrative expenses. During its first year of operations, Bracey produced 27,500 units and sold 25,100 units. The selling price of the company’s product is $75 per unit.

Required:

1. Assume the company uses super-variable costing:

a. Compute the unit product cost for the year.

b. Prepare an income statement for the year.

2. Assume the company uses a variable costing system that assigns $18.00 of direct labor cost to each unit produced:

a. Compute the unit product cost for the year.

b. Prepare an income statement for the year.

3. Assume the company uses an absorption costing system that assigns $18.00 of direct labor cost and $16.50 of fixed manufacturing overhead cost to each unit produced:

a. Compute the unit product cost for the year.

b. Prepare an income statement for the year.

4a. Reconcile the difference between the super-variable costing and variable costing net operating incomes.

4b. Reconcile the difference between the super-variable costing and absorption costing net operating incomes.

Answers

1. In super-variable costing:

a. The unit product cost for the year is $34.

b. The income statement for the year shows a net operating loss of $24,100.

2. In variable costing:

a. The unit product cost for the year is $52.

b. The income statement for the year shows a net operating loss of $46,500.

3. In absorption costing:

a. The unit product cost for the year is $68.50.

b. The income statement for the year shows a net operating income of $58,925.

What is the difference between the net operating incomes in super-variable costing and variable costing systems?In super-variable costing, the unit product cost is determined by including only the direct materials cost per unit ($34) since no fixed costs are allocated to the product.

Therefore, the unit product cost for the year is $34. The income statement reflects a net operating loss of $24,100, calculated as the difference between total variable costs ($34 * 25,100 units) and total sales revenue ($75 * 25,100 units).

In variable costing, a portion of the fixed direct labor cost ($495,000) is assigned to each unit produced, resulting in a higher unit product cost of $52 ($34 + $18). The income statement shows a higher net operating loss of $46,500, as fixed costs are not included in inventory valuation but are expensed in the period incurred.

In absorption costing, both the fixed direct labor cost and fixed manufacturing overhead cost ($453,750) are allocated to each unit produced, resulting in a unit product cost of $68.50 ($34 + $18 + $16.50).

The income statement reflects a net operating income of $58,925, as fixed costs are absorbed into inventory and recognized as expenses when units are sold.

The difference between the net operating incomes in super-variable costing and variable costing arises from the treatment of fixed costs. Super-variable costing omits fixed costs from product cost calculation, resulting in a lower net operating loss.

On the other hand, variable costing includes a portion of fixed costs in product cost, leading to a higher net operating loss. Reconciling the differences between the two approaches requires careful analysis of cost allocation and the impact on profitability.

Learn more about super-variable costing

brainly.com/question/31440680

#SPJ11

Steve has worked 36 hours this week at $10/hour. On his last shift of the week he clocks in at 8:05 am and takes his lunch at 11:53. He comes back from lunch at 12:35 and clocks out at 4:56. How much will Steve's Gross Pay be?

Answers

Answer:

$441.5

Explanation:

Hours already worked = 36 hours

Rate = $10 / day

Number of hours worked on last shift :

8:05 - 11:53 = 3 hours 48 minutes

12:35 - 4:56 = about 4 hours 21 minutes

Total hours (3 hours 48) + (4 hours 21 minutes). = 8 hours 9 minutes

Hence, total hours worked that week :

36 hours + 8hours 9 minutes

44 hours 9 minutes

Rate = $10 / hour

(44*$10) + (9/60 * $10)

$440 + $1.5

Gross pay = $441.5

A sector is a diversified group of companies.

True or False

Answers

Explanation:

A diversified company is a type of company that has multiple unrelated businesses or products. A company may decide to diversify its activities by expanding into markets or products that are related to its current business.

For example, an auto company may diversify by adding a new car model or by expanding into a related market like trucks.

Diversified Industries covers a wide range of sub-sectors including Automotive, Transport & Logistics, Building Materials & Construction, Capital Goods, Business Services, Metals and Oil Field Services. Even the way industrial products are developed, manufactured and commercialized is changing. I would say the answer is True

The funds provided by common stockholders that consist of common stock, paid-in capital, and retained earnings are referred to as the firm's:______.

Answers

The funds provided by common stockholders that consist of common stock, paid-in capital, and retained earnings are referred to as the firm's Net Worth.

What is paid in the capital?

Paid-in capital is the amount that businesses get from stockholders in exchange for their shares. A significant component of a company's entire equity is this. Either preferred stock or the common stock may be used as paid-in capital. These monies are only obtained through the issuer's direct sales of shares to investors; they are not derived from any operating activities or from the sale of stock on the secondary market to other investors.

Paid-in capital does not include earnings from continuing business operations; it only includes money earned from the sale of stock.

If a company decides to repurchase shares from its owners, the balance in paid-in capital may be reduced; this can either be done directly in the account or it can be recorded in a contra equity account that is linked with and offsets the paid-in capital account.

Thus, the investor's money is called Net Worth.

For more information on Net Worth, refer to the given link:

https://brainly.com/question/12294231

#SPJ4

If you are sure that you will be able to pay off the balance of your credit card bill in full each month, you should consider:

A) getting two credit cards, so you always have a line of credit open for use.

B) raising your borrowing limit on your credit card so you can spend more

C) only credit cards that offer a low APR

D) only credit cards that offer zero annual fees even if the APR is high.

Answers

The answer is D, I jus took the quiz so you can trust this answer

When an individual is sure that they will be able to pay off the balance of your credit card bill in full each month, Then it is advisable for the person should consider only using credit cards that offer zero annual fees even if the APR is high.

For better understanding let's explain the terms

Credit cards are often offered by financial companies to its customers for withdrawal of their money from their account. APR is simply known as annual percentage rate. It is the annual interest rate that is charged for using credit.The removal or no annual fee is better for an individual who can pay their credit card bill each month.From the above we can therefore say that the answer When an individual is sure that they will be able to pay off the balance of your credit card bill in full each month, Then it is advisable for the person should consider only using credit cards that offer zero annual fees even if the APR is high, is correct

Learn more from:

https://brainly.com/question/11726945

Sarah receives a semi-monthly salary of $933.20 and works a regular workweek of 40 hours. A. What is Sarah's hourly rate of pay? 5 marks b. If Sarah's gross earnings in one pay period were $1090.19, for how many hours of overtime was she paid at time and one-half regular pay

Answers

Answer:

$10.7677

9.72 hours

Explanation:

Given the following :

Semi-monthly salary = $933.20

Work hours per week = 40 hours

Hourly rate of pay =?

Monthly salary = 2 × $933.20 = $1866.40

Yearly pay = $1866.40 × 12 = $22396.8

Therefore, weekly pay ;

$22,396.80 / 52 = $430.7077

However, Sarah only works for 40 hours per week

Therefore, weekly pay equals;

$430.7077 / 40 = $10.7677

B) if gross pay = $1090.19

Therefore, amount of overtime paid equals:

$1090.19 - $933.20 = $156.99

If overtime pay is one-half regular pay, that is;

1.5 × $10.7677 = $16.152

Therefore, overtime hours equals

Total overtime paid / overtime pay rate

$156.99 / $ 16.152 = 9.719

9.72 hours

HELP PLZZZZZZZ ILL GIVE BRAINLYEST OR POINTS

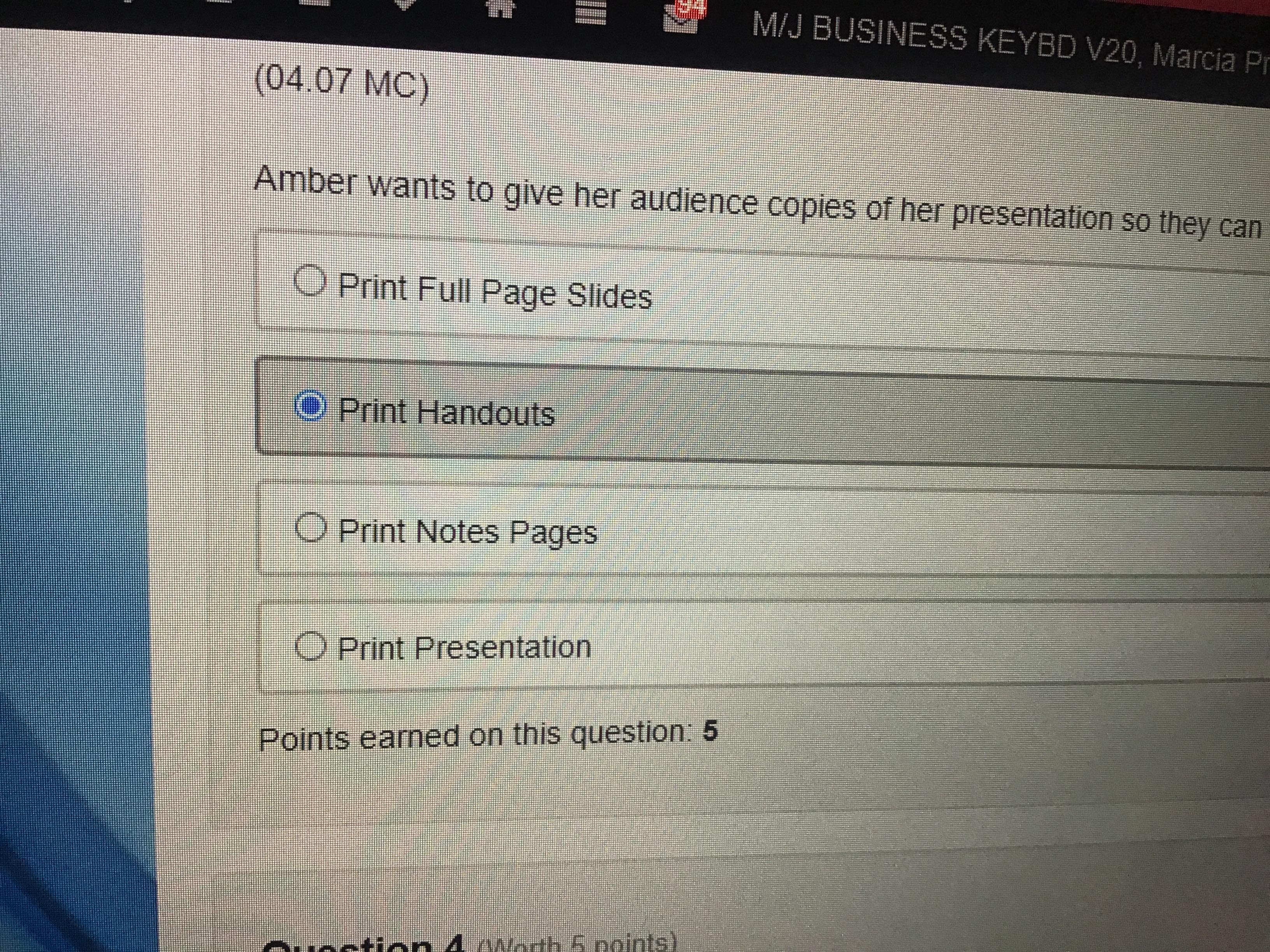

3. (04.07 MC)

Amber wants to give her audience coples of her presentation so they can follow along and take notes. What option should Amber choose in the Print menu? (5 points)

Print Pull Page Slides

O Print Handouts

Print Notes Pages

Print Presentation

Answers

Answer: Print Handouts I got y’all

Explanation:I just checked I got my 5 points for the right answer welcome can I get brainlesist or a heart??.

Answer:

Print handouts

Explanation:

I got it right on the test!!!!!

Vendors submit invoices prior to receiving purchase orders from companies.

True

False

Answers

Answer:

False

Explanation:

Only after the purchase was approved

mork and mindy create a for-profit corporation, mork’s house, to provide shelter to homeless and abused women and children. mork and mindy are shareholders of the corporation. zada is also a shareholder in the corporation, along with five others. douglas manages the day-to-day operations of the corporation. the bylaws of the corporation provide that the corporation is established for the sole purpose of providing shelter, food, and care for homeless and abused women and children and for no other purpose. when the refrigerator in mork’s house stops working, douglas purchases a new refrigerator from home depot and charges it to the corporation. if zada challenges the purchase as going beyond the powers of the corporation:

Answers

It is to be noted that If Zada challenges the purchase as going beyond the powers of the corporation: she will win because purchasing the refrigerator is an ultra vires act. (Option D)

What is an ultra vires act?Ultra vires acts are any acts that go beyond a corporation's power to conduct. Acts of ultra vires extend beyond the powers expressly granted in a corporate charter or by law. This can also apply to any behavior that the company charter expressly prohibits.

The Memorandum and Articles of Association, which serve as the company's constitution, outline the company's main goals, powers, scope, and areas of activity, both internal and external. As a result, a firm can do anything that falls within the scope of the authorities indicated in the Memorandum.

It also has the implicit authority to conduct anything that is tangential to its primary goals. If the corporation goes above the authorities indicated in the Memorandum, it will be considered an Ultra Vires Act.

Learn more about Ultra Vires Act:

https://brainly.com/question/9649116

#SPJ1

Full Question:

Mork and Mindy create a for-profit corporation, Mork’s House, to provide shelter to homeless and abused women and children. Mork and Mindy are shareholders of the corporation. Zada is also a shareholder in the corporation, along with five others. Douglas manages the day-to-day operations of the corporation. The bylaws of the corporation provide that the corporation is established for the sole purpose of providing shelter, food, and care for homeless and abused women and children and for no other purpose. When the refrigerator in Mork’s House stops working, Douglas purchases a new refrigerator from Home Depot and charges it to the corporation. If Zada challenges the purchase as going beyond the powers of the corporation:

a) she will win, because the bylaws do not address purchases of appliances.

b) she will lose, because purchasing the refrigerator falls under the implied powers of the corporation.

c) she will lose, because purchasing the refrigerator is an express power of the corporation.

d) she will win, because purchasing the refrigerator is an ultra vires act.